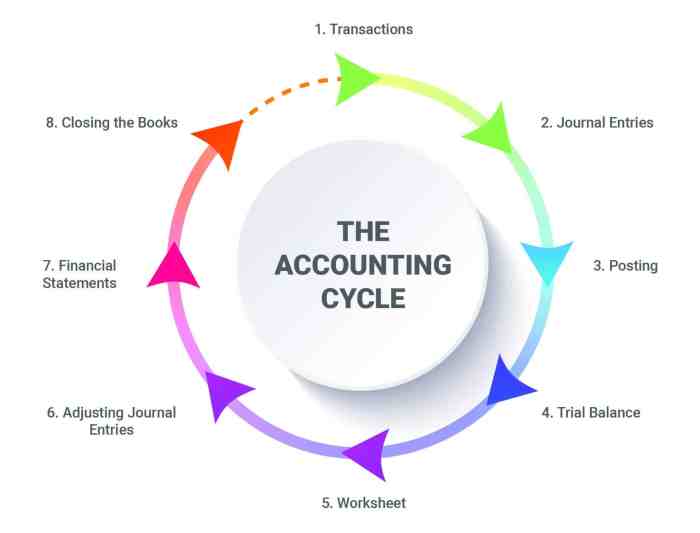

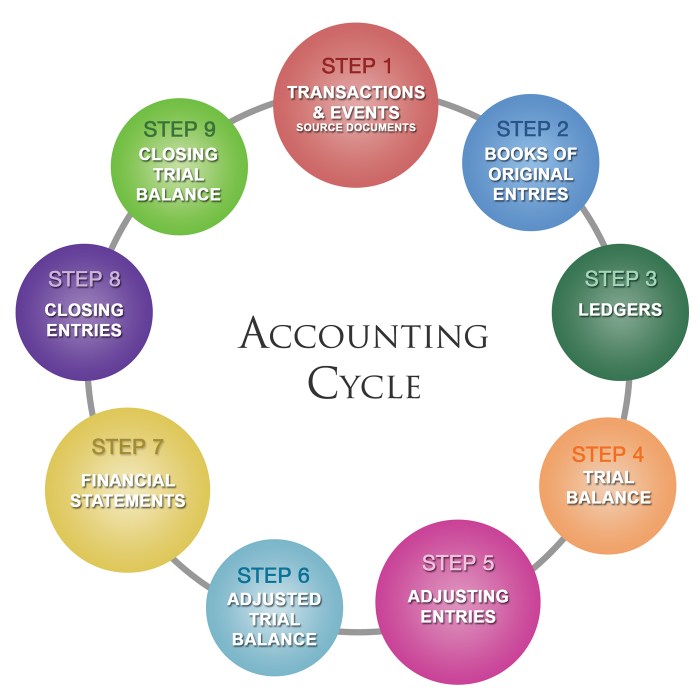

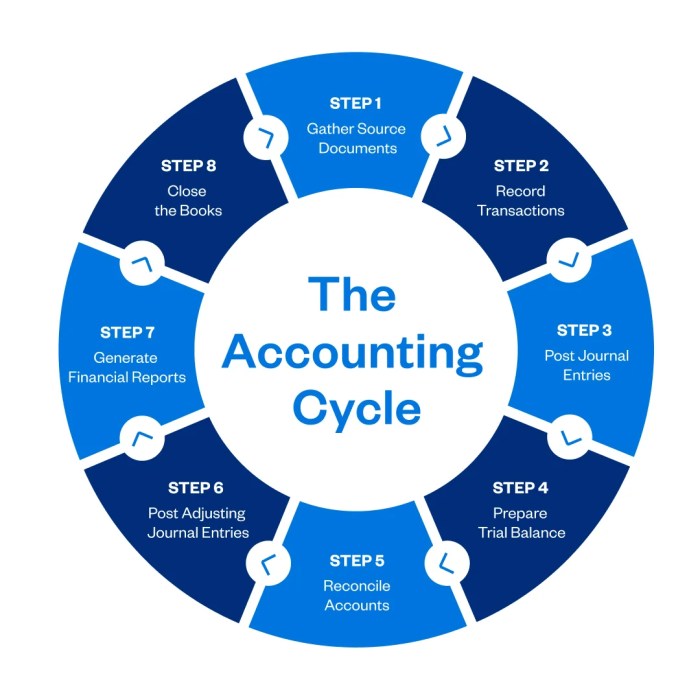

Siklus akuntansi dalam bahasa Inggris, atau accounting cycle, merupakan proses sistematis yang melibatkan serangkaian langkah untuk mencatat, mengklasifikasikan, meringkas, dan melaporkan transaksi keuangan suatu organisasi. Bayangkan siklus akuntansi sebagai sebuah sistem saraf yang kompleks, bekerja tanpa henti untuk mengumpulkan informasi penting tentang keuangan suatu perusahaan.

Dari mencatat setiap transaksi hingga menghasilkan laporan keuangan yang akurat, siklus akuntansi berperan penting dalam pengambilan keputusan bisnis, memantau kinerja, dan memastikan akuntabilitas keuangan. Dengan memahami langkah-langkah dalam siklus akuntansi, Anda dapat memperoleh gambaran yang lebih jelas tentang bagaimana informasi keuangan dikumpulkan, diolah, dan disajikan.

Jurnal dan Buku Besar: Siklus Akuntansi Dalam Bahasa Inggris

The journal and ledger are essential components of the accounting cycle. They play a crucial role in recording and summarizing financial transactions, providing a clear and organized picture of a company’s financial position.

Perbedaan antara Jurnal dan Buku Besar

The journal and ledger are distinct but interconnected components of the accounting system. They differ in their purpose and structure.

- The journal is the initial record of financial transactions. It chronologically records each transaction, including the date, accounts affected, and the amount of the transaction. The journal serves as the primary source of information for posting transactions to the ledger.

- The ledger, on the other hand, is a collection of accounts. Each account represents a specific asset, liability, equity, revenue, or expense. The ledger summarizes the balances of each account, providing a consolidated view of the financial position of the company.

Penggunaan Jurnal dan Buku Besar dalam Siklus Akuntansi

The journal and ledger are integral parts of the accounting cycle. They facilitate the systematic recording and summarizing of financial transactions.

- Jurnal:

- Transactions are initially recorded in the journal, providing a chronological record of all financial activities.

- The journal ensures accuracy by providing a detailed description of each transaction, including the date, accounts affected, and the amount involved.

- It serves as a primary source of information for posting transactions to the ledger.

- Buku Besar:

- The ledger consolidates the balances of all accounts, providing a comprehensive view of the company’s financial position.

- It summarizes all transactions related to a specific account, such as cash, accounts receivable, or inventory.

- The ledger facilitates the preparation of financial statements, as it provides the necessary data for calculating key financial metrics.

Contoh Pencatatan Jurnal dan Buku Besar

Let’s illustrate the use of the journal and ledger with a simple example. Assume a company sells goods for $100 on credit.

- Jurnal Entry:

Date Account Debit Credit 2023-10-26 Accounts Receivable $100 Sales Revenue $100 To record sale of goods on credit - Ledger Entries:

- Accounts Receivable Ledger:

- Date: 2023-10-26

- Debit: $100

- Balance: $100

- Sales Revenue Ledger:

- Date: 2023-10-26

- Credit: $100

- Balance: $100

- Accounts Receivable Ledger:

In this example, the journal entry records the sale on credit, while the ledger entries update the balances of the Accounts Receivable and Sales Revenue accounts. The journal entry provides a detailed description of the transaction, while the ledger summarizes the impact of the transaction on specific accounts.

Financial Statements

Financial statements are a set of reports that summarize the financial performance and position of a company. They are used by investors, creditors, and other stakeholders to make informed decisions about the company.

Types of Financial Statements

There are four main types of financial statements:

- Income Statement: This statement shows the company’s revenue and expenses for a specific period. It is also known as the profit and loss (P&L) statement. It shows how much profit or loss a company made during a particular period.

- Statement of Financial Position: This statement shows the company’s assets, liabilities, and equity at a specific point in time. It is also known as the balance sheet. It shows the company’s financial health and its ability to meet its obligations.

- Statement of Changes in Equity: This statement shows the changes in the company’s equity over a specific period. It explains the changes in the equity section of the balance sheet.

- Statement of Cash Flows: This statement shows the company’s cash inflows and outflows over a specific period. It shows how much cash a company generated and used during a particular period.

Purpose of Financial Statements

Financial statements serve several purposes, including:

- To provide information about the company’s financial performance: This includes information about the company’s profitability, liquidity, and solvency.

- To help investors make informed decisions: Investors use financial statements to assess the company’s financial health and to decide whether to invest in the company.

- To help creditors make informed decisions: Creditors use financial statements to assess the company’s ability to repay its debts.

- To help management make informed decisions: Management uses financial statements to monitor the company’s performance and to make decisions about the company’s future.

Structure and Content of Financial Statements, Siklus akuntansi dalam bahasa inggris

The structure and content of financial statements vary depending on the company and the accounting standards used. However, there are some common elements that are typically included in all financial statements. The format and structure of financial statements are standardized to ensure consistency and comparability. These standards are typically established by regulatory bodies such as the Financial Accounting Standards Board (FASB) in the United States or the International Accounting Standards Board (IASB) for international companies.

- Header: The header includes the company’s name, the statement’s title, and the date or period covered by the statement.

- Body: The body of the statement contains the financial data, which is presented in a clear and concise manner.

- Notes: The notes provide additional information about the financial data presented in the statement. These notes can provide details about accounting policies, significant assumptions, and other relevant information.

The Importance of the Accounting Cycle

The accounting cycle is a fundamental process in any business. It’s the backbone of financial management, ensuring accurate and timely recording of financial transactions, and providing valuable insights for informed decision-making.

Understanding the Importance of the Accounting Cycle

The accounting cycle is a structured process that systematically records, analyzes, and reports financial transactions. It ensures that all financial activities are tracked accurately and consistently, providing a clear picture of a company’s financial health.

- Financial Reporting: The accounting cycle provides the basis for preparing accurate and timely financial statements. These statements, including the balance sheet, income statement, and cash flow statement, are essential for investors, creditors, and other stakeholders to understand a company’s financial performance and position.

- Decision Making: By providing a clear picture of a company’s financial performance, the accounting cycle helps managers make informed decisions about resource allocation, pricing strategies, and other critical business aspects. For example, analyzing sales trends and cost data can guide decisions on product pricing and marketing strategies.

- Compliance and Accountability: The accounting cycle ensures compliance with relevant accounting standards and regulations. This is crucial for maintaining transparency and accountability, building trust with stakeholders, and avoiding legal issues.

The Impact of a Disorganized Accounting Cycle

A poorly structured or disorganized accounting cycle can have severe consequences for a business. It can lead to inaccurate financial reporting, poor decision-making, and even legal issues.

- Inaccurate Financial Reporting: Errors in recording transactions can lead to inaccurate financial statements, which can mislead investors and creditors, potentially affecting their investment decisions or lending terms.

- Poor Decision Making: When financial data is unreliable, managers may make decisions based on inaccurate information, leading to inefficient resource allocation, missed opportunities, and even financial losses.

- Compliance Issues: A disorganized accounting cycle can lead to non-compliance with accounting standards and regulations, resulting in penalties, fines, and reputational damage.

Ringkasan Terakhir

Memahami siklus akuntansi dalam bahasa Inggris membuka pintu menuju pemahaman yang lebih dalam tentang bagaimana informasi keuangan diorganisir dan disajikan. Dengan mempelajari setiap langkah, Anda dapat lebih memahami bagaimana informasi keuangan digunakan untuk membuat keputusan bisnis yang tepat, mengelola sumber daya secara efisien, dan mencapai tujuan keuangan yang ditetapkan.