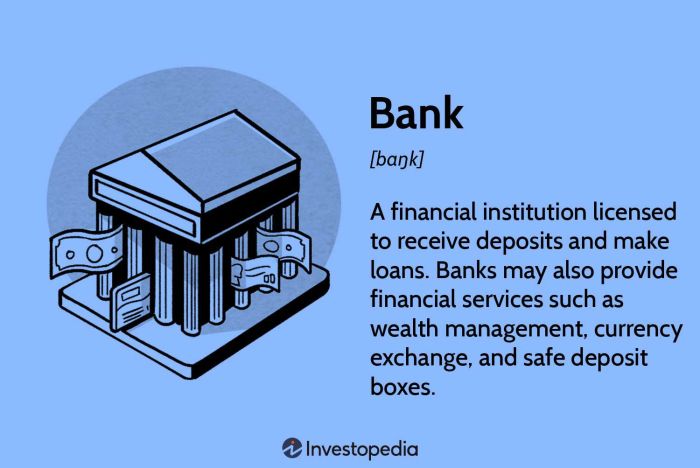

Artikel perbankan dalam bahasa inggris – Pernahkah Anda bertanya-tanya bagaimana sistem perbankan bekerja? Dari menyimpan uang hingga mendapatkan pinjaman, perbankan menjadi bagian penting dalam kehidupan modern. Artikel ini akan menjadi panduan lengkap Anda untuk memahami dunia perbankan, mulai dari definisi dasar hingga tren terkini.

Kita akan menjelajahi berbagai jenis bank, produk dan layanan yang ditawarkan, serta peran penting teknologi dalam membentuk lanskap perbankan saat ini. Anda juga akan mendapatkan pemahaman tentang regulasi, pengawasan, dan tanggung jawab sosial dalam industri ini. Siap untuk menyelami dunia perbankan? Mari kita mulai!

The Role of Technology in Banking: Artikel Perbankan Dalam Bahasa Inggris

The banking industry has undergone a significant transformation in recent years, driven by the rapid advancements in technology. From digital banking to mobile payments and fintech innovations, technology has fundamentally changed the way banks operate and interact with their customers. This has resulted in numerous benefits, including increased efficiency, enhanced customer experience, and the emergence of new opportunities for growth and innovation.

Digital Banking

Digital banking refers to the use of electronic channels, such as websites and mobile apps, to provide banking services. It has revolutionized the way customers manage their finances, offering convenience, accessibility, and a wide range of services.

- Online banking allows customers to access their accounts, transfer funds, pay bills, and manage investments from anywhere with an internet connection.

- Mobile banking provides a similar range of services through mobile apps, enabling customers to bank on the go.

- Digital onboarding simplifies the process of opening accounts, allowing customers to complete the process online, reducing paperwork and wait times.

Mobile Payments, Artikel perbankan dalam bahasa inggris

Mobile payments have become increasingly popular, allowing customers to make purchases using their smartphones or other mobile devices. These services leverage technologies like Near Field Communication (NFC) and QR codes to enable fast and secure transactions.

- Contactless payments, using NFC technology, allow customers to make payments by tapping their phones on a contactless terminal.

- QR code payments involve scanning a QR code with a mobile app to initiate a transaction.

- Mobile wallets, such as Apple Pay and Google Pay, store payment information securely and allow for quick and easy payments.

Fintech Innovations

Fintech, or financial technology, refers to the use of technology to improve and automate financial services. Fintech companies have developed innovative solutions that are disrupting the traditional banking industry, offering alternative and more efficient ways to manage finances.

- Peer-to-peer (P2P) lending platforms connect borrowers and lenders directly, bypassing traditional banks. These platforms often offer lower interest rates and faster loan approvals.

- Robo-advisors provide automated investment advice based on algorithms and customer preferences. They offer personalized investment strategies at a lower cost compared to traditional financial advisors.

- Cryptocurrency and blockchain technology are transforming the way transactions are conducted, offering decentralized and secure alternatives to traditional financial systems.

Benefits of Technology in Banking

The integration of technology into banking operations has brought numerous benefits, improving efficiency, enhancing customer experience, and fostering innovation.

- Increased efficiency: Technology automates many processes, reducing manual tasks and operational costs. This allows banks to provide services faster and more efficiently.

- Enhanced customer experience: Digital banking and mobile payments provide customers with greater convenience, accessibility, and personalized services. This has led to increased customer satisfaction and loyalty.

- New opportunities for growth and innovation: Fintech innovations are creating new products and services, expanding the reach of banking services to previously underserved populations and fostering financial inclusion.

Challenges of Technology in Banking

Despite the benefits, incorporating technology into banking operations also presents challenges.

- Cybersecurity risks: The increasing reliance on technology exposes banks to cybersecurity threats, such as data breaches and fraud. Banks need to invest in robust security measures to protect customer data and systems.

- Regulation and compliance: The rapid pace of technological change creates challenges for regulators to keep up with the latest innovations and ensure compliance with existing laws and regulations.

- Digital divide: Not everyone has access to technology, creating a digital divide that can exclude certain segments of the population from accessing banking services. Banks need to find ways to reach underserved populations and provide them with access to financial services.

Technology Transforming the Customer Experience

Technology has transformed the way banks interact with their customers, creating a more personalized and seamless experience.

- Personalized recommendations: Banks can leverage customer data to provide personalized recommendations for products and services, improving customer engagement and satisfaction.

- Chatbots and virtual assistants provide instant support and answers to customer inquiries, enhancing customer service efficiency.

- Data analytics allows banks to better understand customer behavior and preferences, enabling them to tailor their products and services to meet specific needs.

New Opportunities in the Banking Sector

Technology has created new opportunities for growth and innovation in the banking sector.

- Open banking allows customers to share their financial data with third-party applications, creating opportunities for new financial products and services.

- Artificial intelligence (AI) is being used to automate tasks, detect fraud, and provide personalized financial advice.

- Blockchain technology is enabling new forms of financial transactions, such as peer-to-peer lending and digital asset management.

Penutup

Memahami sistem perbankan sangat penting untuk mengelola keuangan Anda dengan bijak dan berpartisipasi aktif dalam perekonomian. Dengan pengetahuan yang tepat, Anda dapat membuat keputusan finansial yang cerdas dan memanfaatkan berbagai layanan perbankan yang tersedia. Ingatlah, dunia perbankan terus berkembang, jadi tetaplah mengikuti perkembangan terkini untuk memaksimalkan pengalaman perbankan Anda.