Bahasa inggris faktur pajak – Faktur pajak adalah dokumen penting dalam setiap transaksi bisnis. Memahami bahasa Inggris dalam konteks faktur pajak sangat krusial, terutama bagi Anda yang terlibat dalam bisnis internasional atau berinteraksi dengan klien asing. Dengan memahami terminologi dan format faktur pajak dalam bahasa Inggris, Anda dapat meningkatkan efisiensi dan profesionalitas dalam menjalankan bisnis Anda.

Artikel ini akan membahas secara detail tentang faktur pajak dalam bahasa Inggris, mulai dari pengertian, jenis, isi, format, peraturan, contoh, hingga peran pentingnya dalam bisnis. Anda akan mendapatkan pemahaman yang komprehensif tentang faktur pajak dalam bahasa Inggris, sehingga dapat berkomunikasi dengan lancar dan efektif dalam transaksi internasional.

Pengertian Faktur Pajak

Faktur pajak adalah dokumen penting dalam transaksi jual beli yang melibatkan Pajak Pertambahan Nilai (PPN). Dokumen ini berisi informasi mengenai transaksi yang terjadi, termasuk jumlah barang atau jasa yang diperjualbelikan, harga, dan jumlah PPN yang dikenakan. Faktur pajak digunakan untuk mengklaim kembali PPN yang telah dibayarkan oleh pembeli, dan untuk pelaporan pajak oleh penjual.

Pengertian Faktur Pajak dalam Bahasa Inggris

Dalam bahasa Inggris, faktur pajak disebut sebagai “tax invoice” atau “VAT invoice”. Ini adalah dokumen yang berisi detail transaksi yang melibatkan PPN, termasuk jumlah barang atau jasa yang dijual, harga, dan jumlah PPN yang dikenakan. Faktur pajak digunakan untuk mengklaim kembali PPN yang telah dibayarkan oleh pembeli, dan untuk pelaporan pajak oleh penjual.

Contoh Kalimat tentang Faktur Pajak dalam Bahasa Inggris

Berikut adalah contoh kalimat dalam bahasa Inggris yang menjelaskan tentang faktur pajak:

A tax invoice is a document that provides a detailed record of a transaction involving Value Added Tax (VAT), including the quantity and description of goods or services, the price, and the amount of VAT charged.

Istilah terkait Faktur Pajak dalam Bahasa Inggris

Berikut adalah beberapa istilah terkait faktur pajak dalam bahasa Inggris:

- Value Added Tax (VAT)

- Tax Invoice

- VAT Invoice

- Taxable Supply

- Taxable Amount

- VAT Rate

- VAT Registration Number

Invoice Contents

An invoice is a document that details the goods or services that have been provided by a seller to a buyer, along with the price and payment terms. It serves as a formal record of the transaction and is often used for tax purposes. It is important to ensure that all necessary information is included on the invoice, as this can help to prevent disputes or misunderstandings later on.

General Contents of an Invoice

The specific contents of an invoice may vary depending on the country or region in which it is issued. However, there are some common items that are typically included on most invoices. These include:

- Invoice Number

- Invoice Date

- Seller’s Name and Address

- Buyer’s Name and Address

- Description of Goods or Services

- Quantity

- Unit Price

- Total Amount

- Payment Terms

- Tax Information

Invoice Number

The invoice number is a unique identifier that is assigned to each invoice. This number helps to track the invoice and ensure that it is not duplicated. It is typically a sequential number that is generated by the seller’s accounting system.

Invoice Date

The invoice date is the date on which the invoice was issued. This date is important for determining the payment due date and for tax purposes.

Seller’s Name and Address

The seller’s name and address are included on the invoice so that the buyer knows who is issuing the invoice. This information is also important for tax purposes.

Buyer’s Name and Address

The buyer’s name and address are included on the invoice so that the seller knows who is receiving the goods or services. This information is also important for tax purposes.

Description of Goods or Services

The description of goods or services is a detailed description of the items that are being sold. This description should be clear and concise, and it should include all relevant information, such as the quantity, unit price, and any applicable discounts or surcharges.

Quantity

The quantity is the number of items that are being sold. This information is important for calculating the total amount due.

Unit Price

The unit price is the price per item. This information is important for calculating the total amount due.

Total Amount

The total amount is the sum of all the line items on the invoice. This is the amount that the buyer owes to the seller.

Payment Terms

The payment terms specify how the buyer is expected to pay for the goods or services. This information may include the payment due date, the method of payment, and any applicable discounts or penalties.

Tax Information

The tax information includes the applicable tax rates and the amount of tax that is being charged. This information is important for tax purposes.

For example, an invoice might include the following information:

Invoice Number: 12345

Invoice Date: January 1, 2023

Seller’s Name: ABC Company

Seller’s Address: 123 Main Street, Anytown, USA

Buyer’s Name: XYZ Company

Buyer’s Address: 456 Elm Street, Sometown, USA

Description of Goods or Services: 100 widgets

Quantity: 100

Unit Price: $10.00

Total Amount: $1,000.00

Payment Terms: Net 30 days

Tax Information: 6% sales tax

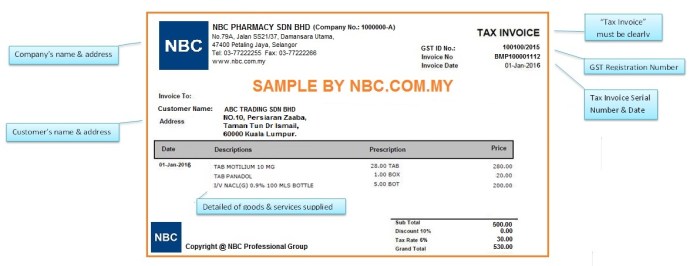

Invoice Format

An invoice is a crucial document in any business transaction, especially when it comes to taxes. It serves as a formal record of the goods or services sold, outlining the total amount due, including any applicable taxes. In this section, we’ll delve into the format of an invoice, specifically focusing on tax invoices, which are essential for claiming input tax credit.

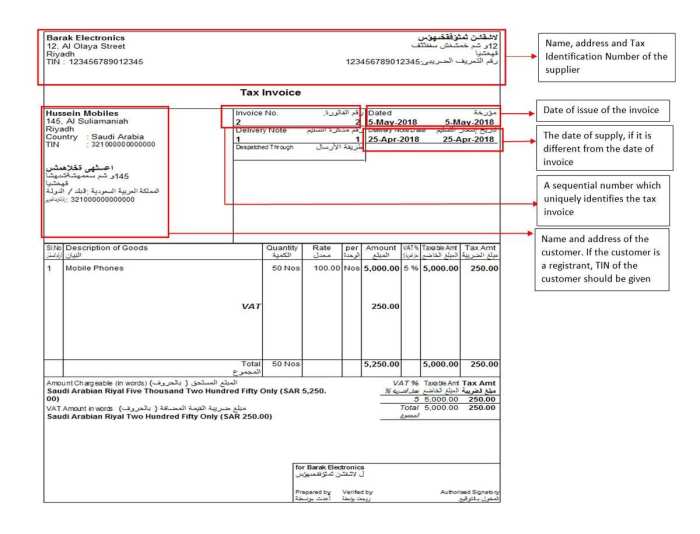

General Format of a Tax Invoice

A tax invoice typically includes the following essential information:

- Invoice Number: A unique identifier for each invoice, typically sequential and chronological.

- Invoice Date: The date on which the invoice was issued.

- Seller Information: The name, address, and tax identification number (TIN) of the seller.

- Buyer Information: The name, address, and TIN of the buyer.

- Description of Goods or Services: A detailed description of the goods or services sold, including quantity, unit price, and total price.

- Tax Rate: The applicable tax rate for the goods or services sold.

- Tax Amount: The calculated tax amount due on the goods or services sold.

- Total Amount Due: The sum of the total price and the tax amount.

- Payment Terms: The payment terms agreed upon by the seller and the buyer, including the due date and payment methods.

- Signature: The signature of the authorized representative of the seller.

Example of a Tax Invoice, Bahasa inggris faktur pajak

Invoice Number: INV-2023-001

Invoice Date: 2023-03-15

Seller: ABC Company

Address: 123 Main Street, City, State, Zip Code

TIN: 1234567890

Buyer: XYZ Corporation

Address: 456 Elm Street, City, State, Zip Code

TIN: 9876543210

Description | Quantity | Unit Price | Total Price

—————————————————————————————————-

Product A | 10 | $10.00 | $100.00

Product B | 5 | $20.00 | $100.00

—————————————————————————————————-

Subtotal: $200.00

Tax Rate: 10%

Tax Amount: $20.00

Total Amount Due: $220.00

Payment Terms: Net 30 days

Signature: [Seller’s Signature]

Differences in Tax Invoice Format for Domestic and International Transactions

While the general format of a tax invoice remains consistent, there might be slight variations depending on whether the transaction is domestic or international. Here’s a breakdown of the key differences:

- Domestic Transactions: In domestic transactions, the tax invoice typically includes details specific to the country’s tax regulations, such as the applicable tax rate and the seller’s tax identification number.

- International Transactions: For international transactions, the tax invoice might require additional information, such as the buyer’s import/export license number, the Harmonized System (HS) code for the goods, and the country of origin. The specific requirements will vary depending on the countries involved in the transaction.

Tax Invoice Examples

A tax invoice is a crucial document in any business transaction. It serves as a record of the goods or services sold, the amount charged, and the applicable taxes. A well-formatted tax invoice ensures transparency and accuracy in financial transactions, simplifying accounting and tax reporting processes.

Example of a Tax Invoice, Bahasa inggris faktur pajak

Here is an example of a tax invoice in English format:

Tax Invoice Invoice Number: INV-2023-001 Date: 2023-03-15 Seller: [Seller's Name] [Seller's Address] [Seller's Tax Identification Number] Buyer: [Buyer's Name] [Buyer's Address] [Buyer's Tax Identification Number] Description | Quantity | Unit Price | Total ---|---|---|--- [Product/Service 1] | [Quantity 1] | [Unit Price 1] | [Total 1] [Product/Service 2] | [Quantity 2] | [Unit Price 2] | [Total 2] [Product/Service 3] | [Quantity 3] | [Unit Price 3] | [Total 3] Subtotal: [Subtotal Amount] Tax (VAT/GST): [Tax Amount] Total: [Total Amount] Notes: [Any relevant notes or additional information] Payment Terms: [Payment terms and conditions]

Explanation of the Tax Invoice

- Invoice Number: A unique identifier for the invoice.

- Date: The date the invoice was issued.

- Seller: Information about the seller, including their name, address, and tax identification number.

- Buyer: Information about the buyer, including their name, address, and tax identification number.

- Description: A detailed description of the goods or services provided.

- Quantity: The number of units or quantity of goods or services sold.

- Unit Price: The price per unit or quantity of the goods or services.

- Total: The total amount charged for each item.

- Subtotal: The total amount of the goods or services before tax.

- Tax (VAT/GST): The amount of tax applied to the goods or services.

- Total: The total amount due, including the subtotal and tax.

- Notes: Any additional information or notes related to the invoice.

- Payment Terms: The terms and conditions for payment, including the due date and accepted payment methods.

Use of Tax Invoices in Transactions

Tax invoices are essential for businesses because they provide a clear and verifiable record of transactions. They are used for various purposes, including:

- Accounting and Tax Reporting: Businesses use tax invoices to track their income and expenses, and to prepare their tax returns.

- Claiming Input Tax Credit: Businesses can claim input tax credit on the goods and services they purchase, using the tax invoice as proof of purchase.

- Auditing: Tax invoices are used by auditors to verify the accuracy of financial records.

- Legal Disputes: In case of any legal disputes, tax invoices can be used as evidence of the transaction.

The Role of Tax Invoices in Business: Bahasa Inggris Faktur Pajak

Tax invoices are essential documents in the business world. They play a crucial role in ensuring transparency, accountability, and compliance with tax regulations. This article will delve into the significance of tax invoices in business operations and explore their benefits.

Importance of Tax Invoices

Tax invoices serve as official records of transactions between businesses and their customers. They provide a detailed breakdown of goods or services purchased, the price, and the applicable taxes. This information is vital for:

- Tracking sales and expenses: Businesses can use tax invoices to monitor their sales and expenses accurately, enabling them to make informed decisions about pricing, inventory management, and financial planning.

- Claiming tax deductions: Businesses can claim tax deductions on their expenses by presenting valid tax invoices. This helps reduce their tax liability and improve their financial performance.

- Ensuring compliance with tax regulations: Tax invoices are essential for complying with tax laws and regulations. They provide evidence of transactions and allow tax authorities to verify the accuracy of tax reporting.

Benefits of Using Tax Invoices

Utilizing tax invoices offers numerous benefits for businesses, including:

- Improved financial management: Tax invoices provide a clear and accurate record of transactions, facilitating better financial planning and decision-making.

- Enhanced customer trust: Issuing tax invoices demonstrates professionalism and transparency, fostering trust and confidence among customers.

- Reduced risk of disputes: Tax invoices serve as legal documents, reducing the likelihood of disputes regarding payments or services rendered.

- Simplified tax filing: Tax invoices streamline the tax filing process by providing all the necessary information for tax returns.

Impact of Tax Invoices on Business

Tax invoices have a significant impact on business operations. They:

enable businesses to manage their finances effectively, comply with tax regulations, and build trust with their customers.

By adhering to proper invoicing practices, businesses can create a strong foundation for growth and success.

Ringkasan Penutup

Memahami bahasa Inggris dalam konteks faktur pajak adalah aset berharga dalam dunia bisnis global. Dengan penguasaan terminologi dan format yang tepat, Anda dapat membangun kepercayaan dengan mitra bisnis internasional, meningkatkan efisiensi transaksi, dan meminimalisir risiko kesalahan. Artikel ini memberikan panduan lengkap untuk membantu Anda menguasai bahasa Inggris faktur pajak dan melangkah lebih percaya diri dalam dunia bisnis internasional.