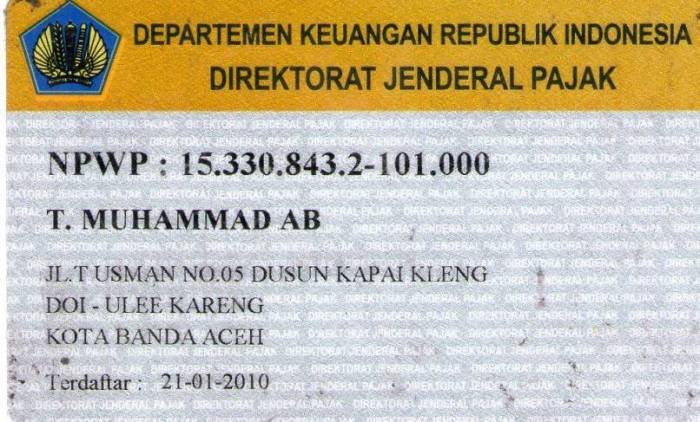

Npwp dalam bahasa inggris – NPWP, singkatan dari Nomor Pokok Wajib Pajak, merupakan identitas wajib pajak di Indonesia. Dalam bahasa Inggris, NPWP disebut sebagai “Taxpayer Identification Number” atau “Taxpayer Registration Number”. NPWP sangat penting bagi setiap individu dan bisnis di Indonesia karena berperan dalam sistem perpajakan dan memudahkan proses pelaporan pajak.

Artikel ini akan membahas secara lengkap tentang NPWP dalam bahasa Inggris, mulai dari definisi, fungsi, persyaratan, cara mendapatkan, hingga pentingnya NPWP dalam berbagai aspek kehidupan, termasuk investasi dan pajak penghasilan.

NPWP and Tax Obligations

Having an NPWP (Taxpayer Identification Number) is a crucial requirement for Indonesian citizens and businesses when it comes to fulfilling their tax obligations. It acts as a unique identifier, linking taxpayers to the tax administration system, and plays a vital role in ensuring transparency and accountability in the tax system.

How NPWP Relates to Tax Obligations

The NPWP is the primary identifier for taxpayers in Indonesia. It connects individuals and businesses to their tax liabilities, ensuring that they are properly registered and accounted for within the tax system. The NPWP is used to track income, expenses, and tax payments, allowing the tax authorities to efficiently manage and monitor tax compliance.

How NPWP Helps Fulfill Tax Obligations, Npwp dalam bahasa inggris

- Accurate Tax Calculation and Reporting: The NPWP facilitates accurate tax calculation and reporting by providing a centralized platform for taxpayers to manage their tax-related information. This allows for seamless tracking of income, deductions, and tax payments, minimizing errors and ensuring compliance.

- Simplified Tax Payment Process: The NPWP simplifies the tax payment process by providing a designated account for each taxpayer. This streamlines transactions, reducing administrative burdens and allowing for efficient tax collection.

- Access to Tax Benefits and Incentives: Having an NPWP enables taxpayers to access various tax benefits and incentives offered by the government. These benefits can include tax deductions, exemptions, and other financial advantages, encouraging compliance and supporting economic growth.

- Proof of Tax Compliance: The NPWP serves as proof of tax compliance, which is essential for various transactions, including property ownership, business registration, and loan applications. It demonstrates a taxpayer’s commitment to fulfilling their tax obligations.

Example of Using NPWP in Fulfilling Tax Obligations

Imagine a small business owner named Sarah who operates a bakery. She has an NPWP and uses it to file her annual tax return. She diligently records her income and expenses throughout the year, using the NPWP to ensure accurate tax calculation. When it’s time to pay her taxes, she utilizes her NPWP to access the designated tax payment portal, making the process efficient and secure. By consistently using her NPWP, Sarah demonstrates her commitment to tax compliance and contributes to the Indonesian tax system.

NPWP and Investment: Npwp Dalam Bahasa Inggris

The NPWP, or Taxpayer Identification Number, is a crucial document in Indonesia that plays a significant role in financial transactions, including investments. Having an NPWP is essential for individuals and businesses to participate in the Indonesian financial market and benefit from various investment opportunities.

How NPWP is Related to Investment

The NPWP is directly linked to investment activities in Indonesia. When you invest, you are essentially engaging in transactions that generate income or capital gains. The Indonesian tax system requires all taxpayers, including investors, to report their income and capital gains, and the NPWP serves as the primary identifier for this purpose. This means that without an NPWP, you cannot legally invest in Indonesia.

How NPWP is Used for Investment

- Opening Investment Accounts: Most financial institutions in Indonesia, such as banks and brokerage firms, require an NPWP to open investment accounts. This is because your investment activities will be recorded and tracked through your NPWP, ensuring compliance with tax regulations.

- Reporting Investment Income and Capital Gains: When you earn income or profits from investments, you need to report them to the Indonesian tax authorities. The NPWP is essential for reporting your investment income and capital gains accurately and efficiently. This ensures that you are paying the correct amount of taxes on your investment activities.

- Claiming Tax Deductions: Certain investment activities allow you to claim tax deductions, such as deductions for contributions to retirement funds or investments in specific sectors. To claim these deductions, you will need to provide your NPWP to the tax authorities.

Example Case

Imagine you are a young professional in Indonesia looking to invest in the stock market. To begin investing, you need to open a brokerage account. The brokerage firm will require you to provide your NPWP as part of the account opening process. Once you start trading stocks, any profits you earn will be reported to the tax authorities using your NPWP. If you sell your shares at a loss, you may be eligible for tax deductions, but you will still need your NPWP to claim these deductions.

Ringkasan Penutup

Memahami NPWP dalam bahasa Inggris sangat penting, terutama bagi Anda yang berinteraksi dengan lembaga internasional atau terlibat dalam transaksi bisnis global. Dengan mengetahui fungsi dan pentingnya NPWP, Anda dapat memenuhi kewajiban pajak dengan lebih mudah dan terhindar dari berbagai konsekuensi hukum.