PPh dalam bahasa Inggris, dikenal sebagai “Personal Income Tax”, merupakan pajak yang dikenakan pada penghasilan individu. Ini adalah salah satu sumber pendapatan utama bagi pemerintah di banyak negara, termasuk Indonesia, dan berperan penting dalam membiayai program-program pembangunan dan kesejahteraan masyarakat.

Artikel ini akan membahas secara komprehensif mengenai PPh dalam bahasa Inggris, mulai dari pengertian, jenis-jenis, sistem perpajakan di Indonesia, tanggung jawab wajib pajak, dampak terhadap ekonomi, cara menghitung, hingga tren dan masa depan PPh.

Pengertian PPh dalam Bahasa Inggris

Personal income tax, commonly known as PPh in Indonesia, is a tax levied on an individual’s income. This means that the government collects a portion of your earnings to fund public services and programs. It’s a significant part of many countries’ tax systems, including Indonesia.

Definition and Example of Personal Income Tax, Pph dalam bahasa inggris

In simple terms, Personal Income Tax (PPh) is a tax you pay on the money you earn from various sources like salary, business profits, investments, and other income-generating activities.

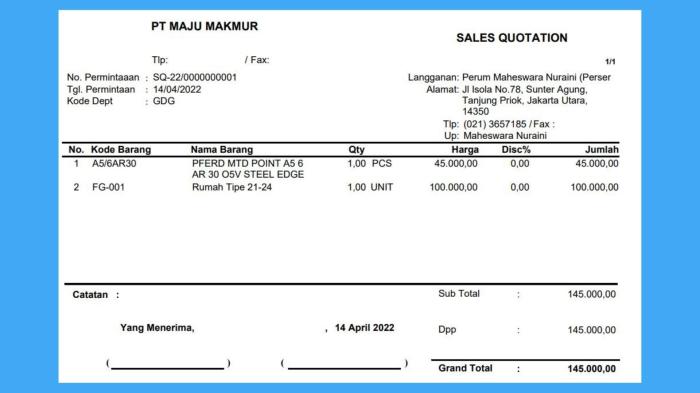

| Term | Definition | Example |

|---|---|---|

| Personal Income Tax (PPh) | A tax levied on an individual’s income from various sources. | John earns a salary of IDR 10,000,000 per month. He pays PPh on his income, contributing to government revenue. |

Types of Personal Income Tax (PPh) in English: Pph Dalam Bahasa Inggris

Personal Income Tax (PPh) is a crucial aspect of any country’s tax system. It plays a vital role in funding public services, infrastructure, and social programs. Understanding the different types of PPh is essential for individuals and businesses alike. This article will explore the various types of PPh in English, highlighting their unique characteristics and providing examples for better comprehension.

Progressive Tax

A progressive tax system is characterized by higher tax rates for higher earners. This means that individuals with higher incomes pay a larger proportion of their income in taxes compared to those with lower incomes. The rationale behind this system is to promote social equity and reduce income inequality. This system aims to ensure that those who have more resources contribute more to the collective good.

Regressive Tax

A regressive tax system, on the other hand, imposes a higher tax burden on lower-income earners compared to higher-income earners. This means that individuals with lower incomes pay a larger percentage of their income in taxes than those with higher incomes. Regressive taxes often affect essential goods and services, disproportionately impacting lower-income households.

For example, a sales tax on groceries is considered regressive because it takes a larger percentage of income from low-income individuals who spend a greater portion of their income on essential goods like food.

Flat Tax

A flat tax system applies a uniform tax rate to all taxpayers, regardless of their income level. This means that everyone pays the same percentage of their income in taxes, irrespective of how much they earn. Flat tax systems are often touted for their simplicity and ease of administration. However, they can also lead to a greater tax burden on lower-income earners, as they have less disposable income to absorb the tax.

Ulasan Penutup

Memahami PPh dalam bahasa Inggris adalah langkah penting untuk setiap individu yang ingin menjadi warga negara yang bertanggung jawab. Dengan memahami hak dan kewajiban terkait pajak, kita dapat berkontribusi dalam membangun negara yang lebih baik dan sejahtera.